PLEASE, STOP RAMBLING: A REJOINDER TO CBN CLAMPS DOWN ON SPECULATORS, RESTRICTS DIASPORA REMITTANCES By David Adenekan.

- 15 Aug, 2023

- 4294 views

#Iroyinominira

25th August,2023

In my previous articles, I have warned that fiscal and monetary policies can only be used as a measure to correct or control certain economic indices and that, it is never a permanent fix.

This is because, the dynamics of the world economy will always adjust to the forces of demand and supply, particularly in a laissez-faire economy. The economic policies of today may become very irrelevant in the not too distance of time.

How long are we going to continue using monetary or fiscal policies to run an artificial forex market in a capitalist economy?

Yes, there is nothing wrong in using monetary policies to control the economy but, the financial crises we are currently facing requires a serious surgerical approach to save the country from economic depression.

Do we have enough liquidity in our foreign exchange reserve that can be used as a monetary policy to boost our forex market?

According to the report gathered from the Punch newspapers, "the data from the quarterly statistical bulletin of the Central Bank of Nigeria, CBN showed that the last time Nigeria made any export earnings from the sales of crude oil was in August 2022. This means that Nigeria has not earned any income from the sales of crude oil for the past seven months. The last time we earned money from the sale of crude oil was in August 2022 to March 2023." At this juncture, it is pertinent to note that more than 90% of our export earnings comes from crude oil.

Also, from the report gathered from the Punch newspapers, "there was no record of the sale of Liquified Natural Gas, LNG from November 2021 to March 2023."

Therefore, where is the dollars coming from, that is needed to boost our foreign exchange reserve and pump money into the forex market to meet the high demand for dollars and thereafter, increase the value of our local currency? Therefore, you cannot initiate any monetary policy to fix the scarcity of dollars in our forex market on a very weak foreign exchange reserve and expect a good result.

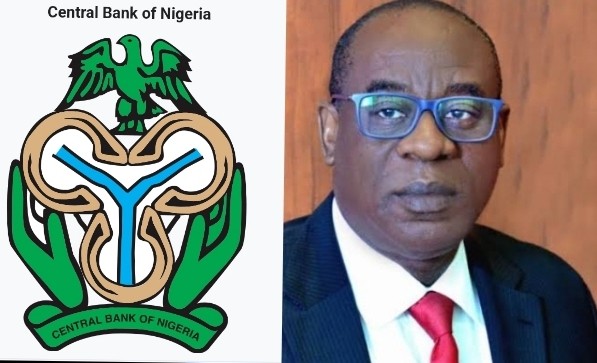

The political brouhaha displayed by the Acting Governor of the Central Bank, Mr. Folashodun Shonubi to stem the tide of naira free-fall, seems like another empty promise. This is because, the reason for the free-fall is very simple; there is a very weak foreign exchange reserve that lacks the capacity to support the high increase in the demand for dollars.

Also, based on the above facts and figures and, as a student of economics, no amount of fiscal or monetary policies can prevent the naira from a free-fall except we have to borrow more money and postpone the evil day or, we woo foreign investors with very big portfolios to increase our liquidity for dollars. Do we even have the bond with great interest rates to attract big foreign investors to increase our liquidity for foreign exchange earnings at this time?

Alas, this is today's unfortunate scenario. It is what it is!

Please, stop rambling and blaming the speculators for a naira free-fall that is fundamentally caused by the forces of demand and supply.

Is this your visit to Aso Rock and the aftermath press release not another way of playing to the gallery?

Suffice it to say, the speculators are the inherent problem of our forex market including some government officials, bank managers and CBN officials are complicit and culpable in this evil deal. Speculators are all over the world but, in the case of Nigeria, some government and bank officials collaborate with the so called speculators to swindle the country of its hard earned foreign exchange reserve.

Oga Acting Governor of Central Bank, are you sure that you know what you are doing, because the naira is in for a free-fall based on the economic indicators we are seeing except if there is a miracle to increase our liquidity in our foreign exchange reserve to boost the availability of dollars in the forex market? This is not rocket science but a simple economic theory that is practicable anywhere in the world.

WE CANNOT BE FOOLED!!!

In the final analysis, an increase in the level of productivity with great earnings, is the best solution to save the naira from a free-fall but then, do we even have any earning from crude oil or liquidfied natural gas at this time or, are we even truly looking inward to diversify our economy to develop our real sectors like agriculture, transportation and health-care to increase our export earnings from these sectors?

In the sixties and seventies, people used to travel from many third world countries to the University College Hospital, Ibadan (UCH) for treatment but today, our elites are the ones taking our foreign currencies to foreign countries for medical treatment. Is this not a depletion on our foreign exchange reserve? Also, is Nigeria still not a mono product economy; crude oil?

Mr. Acting Governor of Central Bank, please stop the rambling and face the realities on the ground in order to properly fix this lingering economic problem we are currently facing as a people.

Yes, the naira is in for a free-fall except if there is a miracle.

Hmmm, call me a sadist!

Yes, only God can save us from the precipice of economic depression; a situation that can take an average of 3 to 5 years to get out of it.

Time will tell.

David Adenekan Is The Editor Of Shekinah International Magazine And A Media Expert.

He Writes From Chicago, Illinois.

Email: davidadenekan5**********

- Category:

- Arts & Culture

- No comments